Finding the right auto coverage can be challenging for drivers in Akron. Whether you’re a new resident or simply reviewing your current policy, understanding the basics of car insurance Akron drivers need can save you time and money. This straightforward guide covers what you need to know about car insurance in the Akron area.

Understanding Ohio’s Insurance Requirements

Like all drivers in Ohio, Akron residents must carry minimum liability insurance that includes:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage

This basic coverage, often referred to as 25/50/25, represents the legal minimum to drive in Ohio. However, many drivers choose additional coverage for better protection.

Common Coverage Options Beyond the Minimum

While state minimums keep you legal on the road, many Akron drivers opt for additional protection:

Collision Coverage: Helps repair or replace your vehicle after an accident, regardless of who was at fault.

Comprehensive Coverage: Protects against non-collision incidents such as theft, vandalism, weather damage, or hitting an animal.

Uninsured/Underinsured Motorist: Provides coverage if you’re in an accident with a driver who has insufficient or no insurance.

Medical Payments: Covers medical expenses for you and your passengers regardless of fault.

Factors That Affect Insurance Rates in Akron

Several basic factors influence what you’ll pay for car insurance in Akron:

Driving Record: A clean driving history typically results in lower premiums.

Vehicle Type: The make, model, and year of your car affect your rates.

Coverage Levels: Higher coverage limits and additional coverages increase your premium.

Credit History: In Ohio, insurers can use credit information when determining rates.

Location: Different neighborhoods within Akron may have different rate structures.

Tips for Finding Affordable Coverage

Here are some straightforward ways to manage your insurance costs:

Compare Multiple Quotes: Rates can vary significantly between insurance providers for the same coverage.

Ask About Discounts: Common discounts include safe driver, multi-policy, good student, and paperless billing discounts.

Review Your Coverage Regularly: As your car ages or your situation changes, your insurance needs may change too.

Consider Your Deductible: A higher deductible usually means a lower premium, but you’ll pay more out-of-pocket if you file a claim.

Benefits of Working with GoAuto Insurance

When shopping for car insurance in Akron, consider providers like GoAuto Insurance that offer customer-friendly features:

- No commissioned agents

- No expensive add-ons

- Low and affordable down payments

- Custom payment plans

- Flexibility to choose your payment date

Understanding the basics of car insurance in Akron doesn’t have to be complicated. By knowing state requirements, considering your personal coverage needs, and comparing options, you can find appropriate coverage that fits your budget.

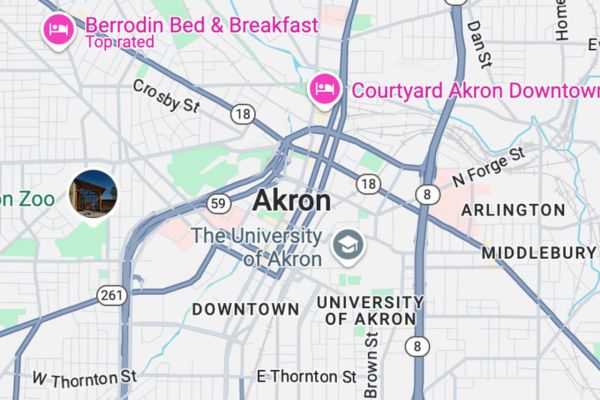

For your convenience, GoAuto’s Akron office is located at 1595 S Hawkins Avenue, Akron,OH, 44320 and can be reached over call directly on 330-869-7788

For assistance finding car insurance in Akron that meets your needs, contact GoAuto Insurance at 833-700-0000 to discuss coverage options and available discounts.

About Go Auto Insurance

Go Auto Insurance is a leading provider of affordable, reliable auto coverage with exceptional customer service across six states. With over 70 offices throughout Georgia, Alabama, Louisiana, Ohio, Texas, and Nevada, the company serves drivers with personalized insurance solutions. Founded on the principle that quality coverage should be accessible to everyone, Go Auto Insurance combines competitive rates with outstanding service and community engagement.